Purchasing an investment property is a major milestone. We asked Pam Naidu, director of marketing and sales at Devmco Realty, how to optimise an investment for maximum returns.

Buying a property is just the beginning of your path to financial growth and generational wealth accumulation. The actions you tak:e subsequently to acquiring your property are pivotal in securing long-term success and profitability. Here’s what you should consider…

CONSIDER THE 3-LAYERS OF LOCATION

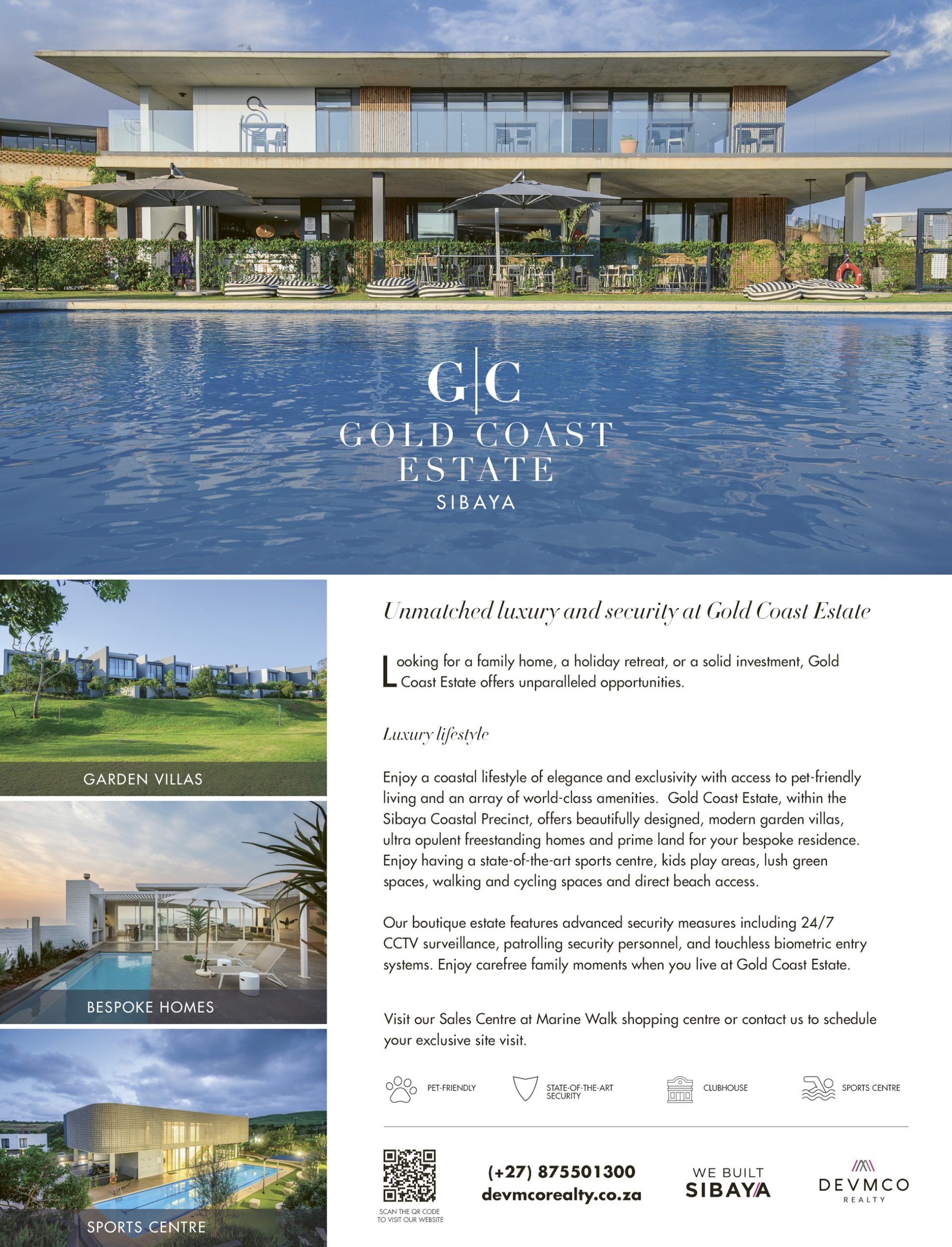

The region, area within that region and the position of your property all play a part in selecting the best location. Investment property situated in a highly sought-after region and estate can attract tenants and generate year-round income while your property appreciates in value. Consider critical factors such as proximity to essential amenities, reputable schools, airports, convenient transportation routes, and thriving business hubs, as these elements significantly impact decisions of renters.

PROPERTIES WITHIN ESTATES

The value of your home within an estate far exceeds those outside of estates. Not only will you be investing in a secure environment, if you purchase properties that are off-plan, you have the benefit of not paying transfer duty, owning a new modern home with upmarket finishes and less trouble with maintenance. Purchasing within an estate also offers your potential tenants peace of mind with enhanced security, well-maintained communal areas, and a strong sense of community.

UNDERSTANDING THE MARKET

Devmco Realty has the edge, as they provide their clients with a better understanding of the rental market, advise on rental price points and help you secure renters that pay on time and look after your asset. While real estate agent insights are paramount, it’s crucial to carry out some of your own investigations and further understand the local property market. Naidu advises, “Staying informed about local market trends is crucial. It helps in making strategic decisions about pricing, marketing,

and even the timing of selling your property in the future.”

FINANCIAL MANAGEMENT

Manage your finances carefully by establishing a dedicated account for your property to effectively monitor income and expenses. Seek advice from a financial advisor to maximise tax advantages linked to owning an investment property, including deductions for bond interest, property taxes, and maintenance costs.

TENANT RELATIONS

Maintaining good relationships with tenants is essential for sustaining a stable rental income. “Devmco Realty take pride in sourcing good tenants and ensure that the lease agreements are clear and comprehensive, outlining the responsibilities of both parties,” explains Naidu. Respecting tenants’ privacy and boundaries, along with showing appreciation and addressing concerns promptly creates a feeling of trust.

REGULAR MAINTENANCE AND INSPECTIONS

Implement a schedule for regular maintenance and inspections. This proactive approach helps maintain the property’s condition, prevent major repairs, and ensures tenant retention. Naidu suggests, “Routine inspections not only protect your investment but also show’s tenants that you care about the property and their well-being.”

STRATEGIC PLANNING

How will this property fit into your long-term investment strategy? You can use your investment property for short or long-term rentals and generate a regular income or you can buy property off-plan and sell it after the value has appreciated.

Details: 087 550 1300, www.devmcorealty.co.za

Tune into the Devmco Realty podcast on Spotify for more tips and insights!