Whether you’re stepping into the property market for the first time or you’re an experienced investor, the real estate market can feel overwhelming with ever-changing trends and a maze of industry jargon. Geoff Perkins, managing director of Collins Residential, breaks down some of the most important property terminology.

RETURN ON INVESTMENT (ROI)

ROI is a fundamental metric that measures the profitability of your investment. It’s calculated by dividing the net profit by the initial cost of the investment. A higher ROI indicates a more profitable investment, making it a critical factor in evaluating property deals.

LOAN TO VALUE (LTV)

LTV ratio compares the amount of your mortgage to the property’s value. It’s a key indicator for lenders to assess risk. A lower LTV typically results in better loan terms and lower interest rates, as it signifies lower risk for the lender.

EQUITY

Equity represents the portion of the property that you truly own, calculated as the difference between the property’s market value and the remaining mortgage balance. Building equity is essential for increasing your net worth and financial stability.

YIELD

Often used in the context of rental properties, yield measures the income return on an investment. It’s expressed as a percentage of the investment cost. Knowing your yield helps assess the profitability and sustainability of your rental property investments.

APPRECIATION

Appreciation refers to the increase in a property’s value over time, influenced by factors such as market conditions, location, and property improvements. Understanding appreciation helps in predicting future value and potential returns.

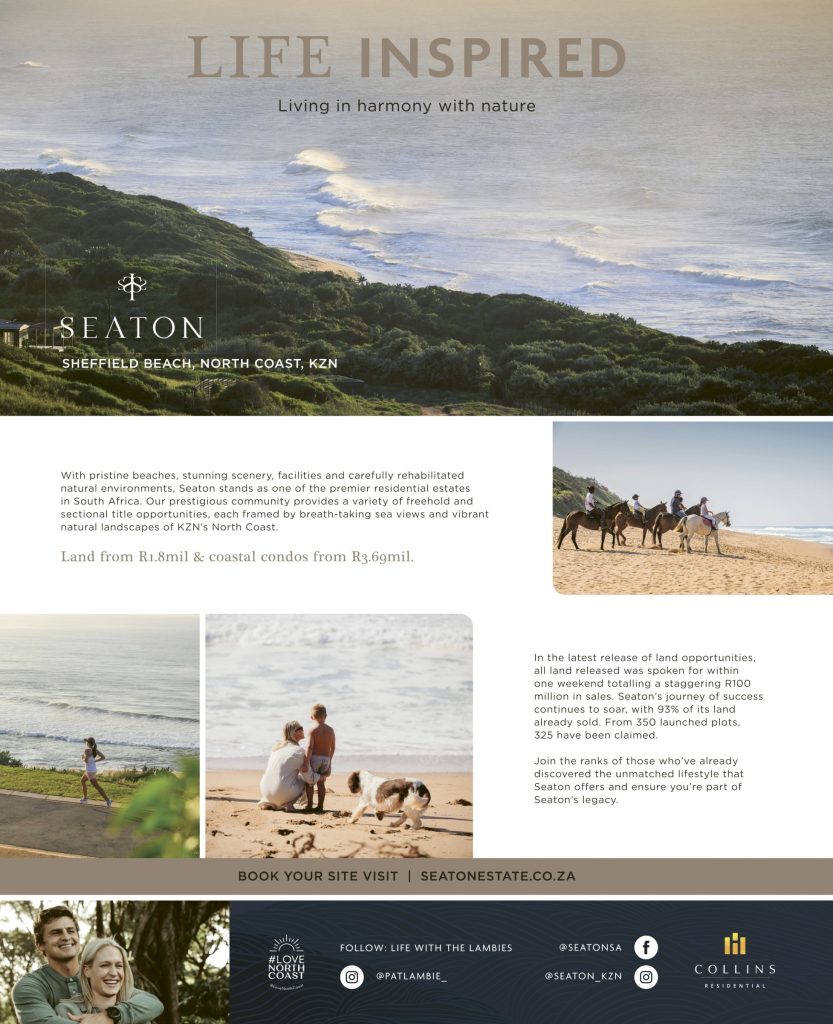

While understanding some key terms is helpful, there are also some nuances to be aware of, such as the importance of location. It’s imperative that when choosing a location to buy property, you consider the growth potential of the area or region. Here on the North Coast, we are fortunate to be part of a bustling economic node whose future looks bright and promises economic growth.

Investing in an estate is also a point to consider, as property values within estates often exceed those outside of estates. An estate such as Seaton is a secure investment for buyers with its potential for above-average appreciation and yield rates. Another thing to consider when buying is the lifestyle you are buying into. With many different estates offering various amenities, aligning with one that fits your family’s needs or your intended renters’ needs is important.

Investing in an estate is also a point to consider, as property values within estates often exceed those outside of estates. An estate such as Seaton is a secure investment for buyers with its potential for above-average appreciation and yield rates. Another thing to consider when buying is the lifestyle you are buying into. With many different estates offering various amenities, aligning with one that fits your family’s needs or your intended renters’ needs is important.

Details: www.seatonestate.co.za